Is 5StarsStocks.com truly the key to unlocking long-term investment success? A bold statement suggests that this platform could revolutionize your approach to wealth-building through its unique blend of artificial intelligence and expert-driven insights. But does it deliver on its promises?

In a world where financial markets are increasingly complex, platforms like 5StarsStocks.com aim to simplify decision-making for investors. By leveraging advanced algorithms and seasoned analysts, the platform offers a comprehensive view of value stocks, consumer staples, and other critical areas of the stock market. Its mission is clear: empower individuals to make informed choices while navigating the volatile landscape of equities trading. However, as with any financial tool, understanding its strengths and limitations is essential before diving in.

| Name | 5StarsStocks.com |

|---|---|

| Founding Year | 2018 |

| Headquarters | New York City, USA |

| Website | Visit Official Website |

| Core Focus | Value Stocks, Consumer Staples, AI-Powered Insights |

| Target Audience | Beginner to Intermediate Investors |

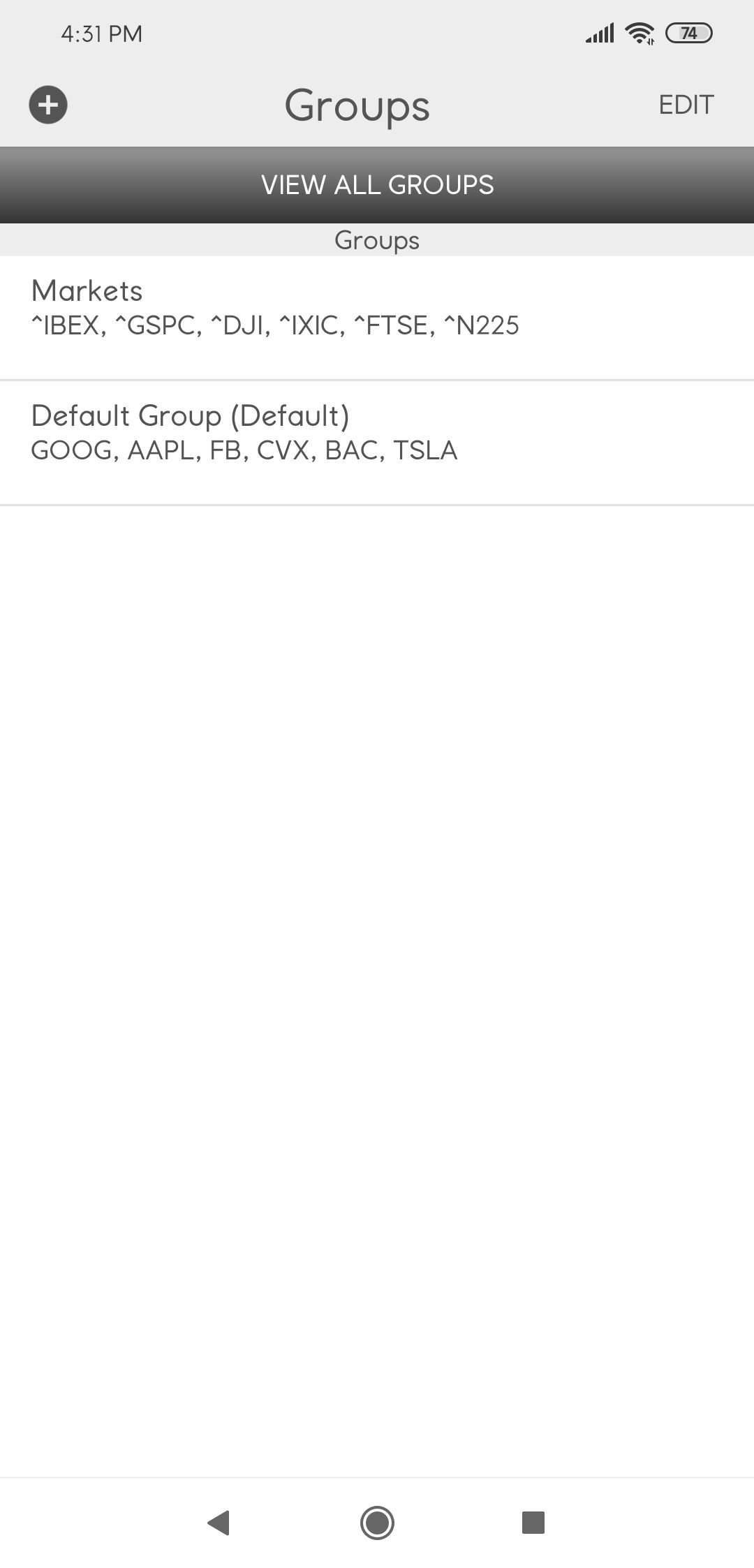

| Key Features | AI-Driven Analysis, Analyst Recommendations, Educational Content |

The concept of value investing has been around for decades, popularized by legends such as Benjamin Graham and Warren Buffett. At its core, value investing involves identifying undervalued companies whose share prices do not reflect their intrinsic worth. Platforms like 5StarsStocks.com have modernized this approach by incorporating cutting-edge technology into the equation. Their proprietary algorithms scan vast datasets to pinpoint opportunities that might otherwise go unnoticed by traditional methods alone.

One area where 5StarsStocks.com excels is in its coverage of consumer staples—a sector known for its stability and resilience during economic downturns. These companies produce essential goods like food, beverages, and household items, ensuring consistent demand regardless of market conditions. By focusing on top performers within this category, the platform provides investors with access to reliable growth prospects without exposing them to excessive risk. Moreover, these investments often come bundled with attractive dividend yields, further enhancing their appeal.

Morningstar's star rating system serves as an additional layer of validation for those considering recommendations from 5StarsStocks.com. This forward-looking metric evaluates a stock's current price relative to its estimated fair value. Stocks trading at significant discounts receive higher ratings, signaling potential upside for buyers. Conversely, those priced above their perceived worth earn lower scores, cautioning against overpaying. While no evaluation method is foolproof, combining Morningstar's analysis with the insights provided by 5StarsStocks.com can create a powerful framework for making sound investment decisions.

However, it is important to approach such platforms critically. Critics argue that some aspects of 5StarsStocks.com may oversimplify the complexities inherent in stock market investing. For instance, relying solely on algorithmic outputs without conducting independent research could lead to suboptimal outcomes. Additionally, inexperienced users might misinterpret data or fail to grasp underlying assumptions behind certain projections. To mitigate these risks, maintaining a balanced perspective and seeking multiple viewpoints remains crucial.

Another factor worth noting is the growing influence of artificial intelligence (AI) across various industries, including finance. As machine learning models continue to evolve, they offer unprecedented capabilities for processing large volumes of information quickly and accurately. In the context of stock trading, AI-powered tools enable real-time monitoring of market trends, sentiment analysis, and predictive modeling—all of which contribute to better-informed strategies. Nevertheless, human oversight remains indispensable when interpreting results generated by automated systems.

For beginners venturing into the realm of equity investments, resources like 5StarsStocks.com provide valuable starting points. They demystify jargon-heavy concepts and present actionable advice tailored to different levels of expertise. Furthermore, educational content available on the site helps bridge knowledge gaps, fostering confidence among newcomers. That said, even seasoned professionals stand to benefit from periodic refreshers on emerging methodologies and best practices.

Ultimately, whether 5StarsStocks.com proves empowering or misleading depends largely on how users engage with its offerings. Those who treat it as one piece of a broader puzzle—supplementing its guidance with thorough due diligence—are more likely to achieve desired outcomes. On the flip side, blindly following suggestions without questioning assumptions increases vulnerability to unforeseen pitfalls. Striking the right balance between trust and skepticism ensures sustainable progress toward long-term financial goals.

As the global economy continues shifting gears post-pandemic, staying abreast of evolving dynamics becomes ever more critical. Investors must remain agile yet disciplined, adapting their approaches as circumstances warrant. Utilizing platforms like 5StarsStocks.com thoughtfully can enhance preparedness for whatever challenges lie ahead. Remember, though: no single solution exists; instead, cultivating a well-rounded skillset empowers individuals to seize opportunities confidently amidst uncertainty.